In this regard, we would like to focus on Ministerial Order HAC7/1177/2024, of 17 October, published on 28 October 2024, which amends the implementing regulation of article 29.2 j of the Spanish General Tax Law (Ley General Tributaria, LGT), establishing certain requirements for electronic accounting, invoicing and management systems. In this context, the said ministerial order is the implementation instrument which further develops Royal Decree RD 1007/2003, which in turn sets out the requirements for IT and electronic systems to support businesses with invoicing as well as standardise the way these invoices are recorded. This connection between the Ministerial Order and the Royal Decree has certain relevance as it influences the implementation deadlines, as we will see below.

Let’s take a look at the details:

Obligations in 2025 under RD 1007/2023 and the Ministerial Order

From 1 July 2025, businesses and professionals with a turnover of less than EUR 6,000,000, i.e. those not required to register in the SII, must use a verifiable eInvoicing system. They have several options

- a) register voluntarily for the SII,

- b) use the VERIFACTU system provided by the AEAT, or

- c) use a responsible and verifiable invoicing system of a private software provider.

What Options Do Businesses Have Today?

The SII is an electronic communication channel provided by the Spanish State Tax Authorities AEAT through which businesses can carry out and manage all VAT procedures, such as VAT returns, statements and the submission of the VAT registers of all sales and purchase invoices.

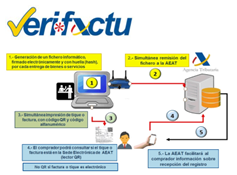

VERIFACTU provides the AEAT with a unique record for each invoice issued in real time and impedes any changes to the original document, thus achieving a complete digitalisation of the invoicing process. The AEAT offers all taxpayers who do not want to or cannot implement a verified eInvoicing system of a private provider to use VERIFACTU for free. The sales invoices must include

- a graphic representation of the invoice in the form of a QR code

- the reference ‘Invoice verifiable via the AEAT web portal’ or ‘VERI*FACTU’ if the public system is used.

In case a business or professional prefers using a private eInvoicing system, the software manufacturer must confirm, by means of a statement of compliance (declaración responsable), that their system meets all the requirements for responsible and verifiable invoicing.

What are the requirements of the law Crea y Crece?

On the other hand, there is the Spanish business promotion law Crea y Crece, which intends to facilitate the incorporation of businesses, fight payment default and promote the use of eInvoicing and financing instruments for business growth.

Crea y Crece establishes electronic invoicing as the only system that may be used in business-to-business relationships. It also requires all businesses and professionals to issue, send and receive electronic invoices in their business relationships, with the following implementation deadlines:

- Businesses with a turnover of more than EUR 8 million: within one year of the adoption of the implementation instrument.

- Businesses with a turnover of less than EUR 8 million: within two years of the adoption of the implementation instrument.

Hence, the law Crea y Crece foresees a general eInvoicing obligation for all companies, regardless of whether they are registered in the SII or not.

VERIFACTU is compatible with the implementation of this Law 18/2022, Crea y Crece, due to the synergies between the two regulations that will lead to better tax compliance by taxpayers, fight tax fraud and prevent late payment and defaults in commercial transactions.

Implementation Deadlines

As stated above, the law Crea y Crece provides for a deadline of one or two years respectively from the adoption of the implementation instrument for the introduction of a compliant eInvoicing system. However, this implementation instrument has not yet been adopted (as the technical regulation of the requirements is still pending). Therefore, there is currently no deadline in this regard.

RD 1007/2023, on the other hand, establishes an implementation deadline for manufacturers of invoicing systems of nine months from the date of the ministerial order. However, since the order was issued with a delay of several weeks, it is not yet clear whether the original date – 1 July 2025 – will be upheld or postponed. There is talk of 1 January 2026 as the new date, but the corresponding official consultation has not yet been confirmed yet by Public Administration.

In light of this, businesses and professionals are well advised to prepare for the introduction of an eInvoicing system (their own or the state system VERIFACTU) in order to meet the requirements applicable to them, regardless of when the implementation will finally be due.

Applicable Norms

- Law 11/2021, of 9 July, on measures to prevent and combat tax fraud.

- Royal Decree RD 1007/2023, of 5 December, adopting the Regulation laying down the requirements for computerised and electronic invoicing systems and programmes for businesses and standardising the collection of invoices (VERIFACTU).

- Ministerial Decree HAC7/1177/2024 of 17 October, published on 28 October 2024, which amends the implementing regulation for Article 29.2.j) of Law 58/2003 of 17 December (ley general tributaria, LGT), with regard to IT accounting systems for businesses.

- Law 18/2022 on the creation and growth of companies, Crea y Crece, of 28 September 2022, which establishes electronic invoicing as the only permissible system for business-to-business relationships.

- Royal Decree RD 596/2016 on the Real-time VAT Information System (Suministro de Información Inmediata, SII) of the AEAT: since July 2017, using the SII has been mandatory for the following taxpayers who pay their VAT on a monthly basis:

-

- Taxable persons registered in REDEME (monthly VAT Refund Register).

- Large companies (turnover of more than EUR 6,010,121.04)

- VAT groups